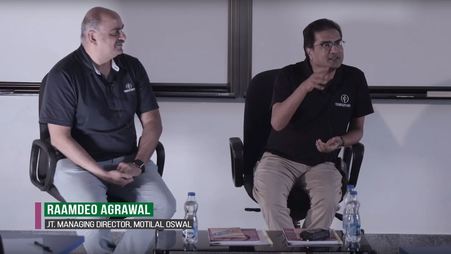

Musings by Mohnish Pabrai... |

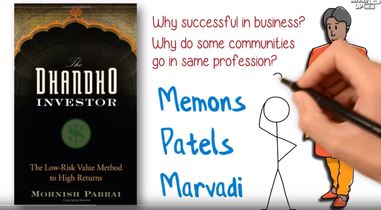

Mohnish Pabrai is the founder and Managing Partner of the Pabrai Investments Funds, the founder and CEO of Dhandho Funds, and the author of The Dhandho Investor and Mosaic: Perspectives on Investing.

|

Beware of Scams Using My Name - Mohnish Pabrai

Session with Rotary Bangalore DownTown and Fellowship of Wealth Creators on June 19, 2024

Enjoy!

www.youtube.com/watch?v=uzp37XkxWxY

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session at The University of Nebraska, Omaha on May 3, 2024

Enjoy!

www.youtube.com/watch?v=FFxUSADENrc

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with Dakshana Scholars at the JNV Pune on December 25, 2023

Enjoy!

www.youtube.com/watch?v=bUUl4trjNC8

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview at the My First Million Podcast on April 4, 2024

Enjoy!

www.youtube.com/watch?v=TyYRrfY3_zM

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session with Dakshana scholars at the JNV Bangalore Urban on December 24, 2023

Enjoy!

www.youtube.com/watch?v=ktBWoEHl9UU

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session at The Investor’s Podcast on April 1, 2024

Enjoy!

www.youtube.com/watch?v=kTXZO5N_FK4

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session with MIT's Brass Rat Investments on March 12, 2024

Enjoy!

www.youtube.com/watch?v=yHIz0WlMnMc

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with Dakshana scholars at the JNV Kottayam on December 21, 2023

Enjoy!

www.youtube.com/watch?v=R_pnRg24btM

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session with YPO’s Mosaic Chapter on March 20, 2024

Enjoy!

www.youtube.com/watch?v=pu8M0SsqRtg

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript

Q&A session with Dakshana scholars at JNV Bangalore (Rural) on December 24, 2023

Enjoy!

www.youtube.com/watch?v=D1n2qgcQoI4

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

The 2024 Uber Cannibals

The Final Post in the Free Lunch Series

These portfolios were an opportunity to shine light on concentrated strategies in high quality corners of the market. It has been over 7 years since we started presenting our picks. The performance of the portfolios since inception is presented below.

This post will be the final update in this series. My team will no longer be updating the Free Lunch Portfolio and highlighting new businesses. Our efforts have shifted solely to our day job of managing our funds.

Recap of 2023 Uber Cannibals:

As a recap, in my 3/31/17 blog post, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals compounding journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio every year in April. The 2023 Uber Cannibals were:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- eBay (EBAY)

- Toll Brothers (TOLL)

As of 3/31/24, Sonia's $100k was worth $266,463 up 14.5% annualized since inception. If Sonia had instead invested in the S&P 500 over that period, she would be up 14.5% annualized and her portfolio would be worth $266,860. Uber Cannibals was up 56.0% in the last 12 months, vs. 29.9% for the S&P 500. Uber Cannibals has outperformed the S&P 500 for the last 12 months, despite no exposure to high-flying tech names. The Uber Cannibals 5-stock portfolio is far more concentrated than the indices and will be more volatile.

|

Last 12 Months |

Since 1/3/17 |

Value of $100k invested on 1/3/17 |

Since 1/3/17 (annualized) |

Uber Cannibals |

56.0% |

166.5% |

$266,463 |

14.5% |

S&P 500 |

29.9% |

166.9% |

$266,860 |

14.5% |

Small Dogs of the Dow |

-16.0% |

4.0% |

$104,028 |

0.5% |

Please note, the Uber Cannibals performance assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas S&P 500 and Small Dogs of the Dow performance assumes that stocks are bought at last close.

The New 2024 Uber Cannibals:

Here are the 2024 Uber Cannibals:

- Alpha Metallurgical Resources (AMR)

- AutoNation (AN)

- Primerica (PRI)

- eBay (EBAY)

- Toll Brothers (TOLL)

Sell Assured Guaranty and Jack in the Box and invest the proceeds equally in AMR and AutoNation. The swaps are no-brainers at present prices (the threshold we need to meet to make a change to the portfolio). AMR and AutoNation operate in out-of-favor industries and generate a significant amount of free cash flow.

If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five).

As a reminder, in December 2023, we added AMR to the Free Lunch portfolio as a Shamelessly Cloned idea. As of 3/31/24, the weight of AMR in the free lunch portfolio is 3.3% if you had been investing in the free lunch portfolio since 2018 and 6.3% if you started investing in the free lunch in 2024. Considering these low weights for AMR, we don’t see any concentration issues adding it as a cannibal as well.

Free Lunch Portfolio:

We published the 2024 Free Lunch Portfolio in December 2023. The Free Lunch portfolio was up 13.7% in Q1 2024, vs. 10.6% for the S&P 500. The portfolio managed to outperform the high-flying S&P 500 in 2024. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up 7.8% while the S&P is up 13.4%. The S&P 500 has trounced the Free Lunch portfolio so far. In 2021 we decided to ignore the algorithm’s buy and sell decisions and only make portfolio tweaks if they are no-brainers. Since 2021, the Free Lunch portfolio is up 21.2% versus 14.3% for the S&P 500.

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Session with Columbia Business School (CSIMA) on February 14, 2024

Enjoy!

www.youtube.com/watch?v=ZrJA8q5Yixg

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session at the SumZero Virtual Investor Summit 2024 on February 8, 2024

Enjoy!

www.youtube.com/watch?v=mi134c5X3ps

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with Value Investing Society at London School of Economics on January 30, 2024

Enjoy!

https://www.youtube.com/watch?v=1xpY7-uyPqo

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview at Morningstar, The Investor's Mind on December 1, 2023

Enjoy!

https://www.youtube.com/watch?v=gghOEu8u6pE

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at FLAME University on December 25, 2023

Enjoy!

https://www.youtube.com/watch?v=A2vC2skCjCs

You can see the presentation here.

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A at Oxford University - Oxford Alpha Fund on November 21, 2023

Enjoy!

https://www.youtube.com/watch?v=0qxxVBKd8CI

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

You can also read the interview published by Oxford Alpha Fund in The Walton Edge - Volume 1 Series 3.

Q&A at Clemson University - Wall Street South Investment Club on November 13, 2023

Enjoy!

https://www.youtube.com/watch?v=IJwOjG5gwAw

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

2024 Free Lunch Portfolio

The Free Lunch portfolio was up 30.3% in 2023, vs. 26.3% for the S&P 500. The portfolio managed to outperform the high-flying S&P 500. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up 5.8% while the S&P is up 12.1%. The S&P 500 has trounced the Free Lunch portfolio so far. In 2021 we decided to ignore the algorithm’s buy and sell decisions and only make portfolio tweaks if they are no-brainers. This bias towards inaction will avoid disrupting the compounding engine and should help the Free Lunch perform well over time. Since 2021, the Free Lunch portfolio is up 34.2% versus 33.1% for the S&P 500.

Tweaks to the 2024 Free Lunch Portfolio:

From our fund managers list, we replace ValueAct Capital, FPA and Sequoia Fund with Abram’s Capital, Brave Warrior Advisors and Greenlight. This December, we recommend adding Alpha Metallurgical Resources (AMR), Consol Energy, Lithia Motors and Asbury Automotive. We love these businesses. To bring them in, we recommend selling Alibaba (Cloned Idea), Tencent (Cloned Idea), Restaurant Brands (QSR) and Starbucks (Spawner). The swaps are no-brainers at present prices (the threshold we need to meet to make a change to the portfolio). AMR, Consol, Lithia and Asbury all operate in out-of-favor industries and generate a significant amount of free cash flow.

Here are the constituents for the upcoming year:

Spawners

- TAV Airports (TAVHL.IS)

- Alphabet (GOOGL)

- Reysas Logistics (RYSAS.TI)

- Microsoft (MSFT)

- Brookfield Corp. (BN)

- Brookfield Asset Management (BAM) – a spin-off from Brookfield Corp.

Shameless Cloning

- Alpha Metallurgical Resources (AMR), from Pabrai Funds

- Lithia Motors (LAD), from Brave Warrior Advisors

- Chipotle Mexican Grill (CMG), from Pershing Square

- Asbury (ABG), from Abram’s Capital

- Consol Energy (CEIX), from Greenlight

Uber Cannibals

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- eBay (EBAY)

- Toll Brothers (TOL)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 16 stocks (i.e., invest the same amount of money in each of these 16) between now and early January 2024.

If you are already invested in the Free Lunch Portfolio, and you rebalanced the Uber Cannibals in April 2023 with the New Uber Cannibals, then sell Alibaba, Tencent, Restaurant Brands and Starbucks and invest the proceeds equally between AMR, Consol, Lithia and Asbury.

As a reminder, the new Uber Cannibals get published every April, while the new Spawners and Shameless Cloning businesses are released in January. When we publish the new Uber Cannibals in April 2024, sell the Ubers that are no longer on the new list and invest the proceeds equally across the new Uber Cannibal picks. Then in January 2025, you’ll rebalance the Spawners and Shameless Cloning ideas.

Enjoy!

It is not easy for US retail investors to buy stocks listed on the Istanbul Stock Exchange, but Fidelity does offer the service to trade Turkish stocks by phone. Once you open an account at Fidelity.com and fund it, you can call Fidelity at +1.800.343.3548, ask for “international trading” and advise the Fidelity representative of your order. Trades are placed in Turkish Lira, so the representative can help you determine the correct number of shares that you can buy with your USD balance, after accounting for possible movements in the Turkish Lira overnight. Trades need to be placed between 5 AM and 7 PM eastern. Limit orders are generally the best way to go. To our knowledge, Fidelity is the only game in town that offers Turkish trading to US retail investors, and it charges a hefty commission (approx. $83 per ticket order). To avoid racking up significant commission charges, you will want limit the number of orders you place and try to maximize the number of shares you buy per ticket order.

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome. The contents of this website are for educational and entertainment purposes only, and do not purport to be, and are not intended to be, financial, legal, accounting, tax or investment advice. Investments or strategies that are discussed may not be suitable for you, do not take into account your particular investment objectives, financial situation or needs and are not intended to provide investment advice or recommendations appropriate for you. Before making any investment or trade, consider whether it is suitable for you and consider seeking advice from your own financial or investment adviser.

Conversation at Schroders - The Value Perspective podcast on October 10, 2023

Enjoy!

https://www.youtube.com/watch?v=w9oC1rPV5yQ

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A at Boston College, Carroll School of Management on October 12, 2023

Enjoy!

https://www.youtube.com/watch?v=jZKOk-hlo8I

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Talk at the YPO Waterloo Austin on October 17, 2023

Enjoy!

https://www.youtube.com/watch?v=EzMWPRx9-CY

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A at Mendoza College of Business - University of Notre Dame on September 29, 2023

Enjoy!

https://www.youtube.com/watch?v=kfgbTNWLMJE

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session at the Harvard Business School on September 15, 2023

Enjoy!

https://www.youtube.com/watch?v=MDuPszGThmE

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview at the Meb Faber Show on July 28, 2023

Enjoy!

https://www.youtube.com/watch?v=HhA8WfnEw9I

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at MDI, Gurgaon on December 26, 2014

https://www.youtube.com/watch?v=JSHVXBBb9bI

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview with Weekly on Stocks on June 28, 2023

Enjoy!

https://www.youtube.com/watch?v=Y0K1qVJdJxc

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at Indian School of Business on July 13, 2013

Enjoy!

https://www.youtube.com/watch?v=PpBPzNoltbs

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at MDI, Gurgaon on December 22, 2015

https://www.youtube.com/watch?v=OFkApI6zZtY

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with members of the Finance and Investment Cell at SRCC, Delhi on June 14, 2023

Enjoy!

https://www.youtube.com/watch?v=tYtG7ZvMSjM

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with the Finance Club of IIT Patna on May 10, 2023

Enjoy!

https://www.youtube.com/watch?v=Qgtb7LnvP6Y

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview at the Investor's Podcast on April 25, 2023

Enjoy!

https://www.youtube.com/watch?v=DtQVYvyO4Qg

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at the JNV Lucknow on December 27, 2022

https://www.youtube.com/watch?v=hDCt342Izag

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at the University of Nebraska, Omaha on May 5, 2023

Enjoy!

https://www.youtube.com/watch?v=SP6kKi2nMz4

with the Presentation slides here.

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at the JNV Pune on December 25, 2022

https://www.youtube.com/watch?v=Skh3U9YNgYo

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at the Dakshana Valley, Pune on December 26, 2022

https://www.youtube.com/watch?v=WyGEPA1imZg

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview at the mint-Equitymaster Investor Hour on April 11, 2023

https://www.youtube.com/watch?v=ibsxgKdJNpA

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at JNV Bundi on December 24, 2022

https://www.youtube.com/watch?v=7yr76gcodKQ

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at the University of Texas on February 28, 2023

Enjoy!

https://www.youtube.com/watch?v=UcJB1m3cXKw

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at JNV Bengaluru (Urban) on December 23, 2022

https://www.youtube.com/watch?v=sjb4Tv_X0xg

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Chat with students at the Rotman School of Management on March 3, 2023

Enjoy!

https://www.youtube.com/watch?v=miqfRmUDwFQ

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

The 2023 Uber Cannibals

We are now ready for the April 2023 Uber Cannibals picks.

Recap of 2022 Uber Cannibals:

As a recap, in my 3/31/17 blog post 6 years ago, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals compounding journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio every year in April. The 2022 Uber Cannibals were:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- Navient (NAVI)

- Discover Financial Services (DFS)

As of 3/31/23, Sonia's $100k was worth $170,766, up 8.9% annualized since inception. If Sonia had instead invested in the S&P 500 over that period, she would be up 12.2% annualized and her portfolio would be worth $205,465. The Uber Cannibals portfolio was down 3.7% in the last 12 months, vs. the S&P 500 which was down 7.7%. Over the last three years, Uber Cannibals was up 24.2% annualized vs. 18.6% for the S&P 500. The Uber Cannibals 5-stock portfolio is far more concentrated than the indices and will be more volatile. The strategy makes sense if you intend to follow it for at least a decade or two (or longer). Sonia’s in it for the long run.

Value |

Last 12 Month |

Since 1/3/17 |

Value of $100k invested on 1/3/17 |

Since 1/3/17 (annualized) |

Uber Cannibals |

-3.7% |

70.8% |

$170,766 |

8.9% |

S&P 500 |

-7.7% |

105.5% |

$205,465 |

12.2% |

Small Dogs of the Dow |

-16.0% |

-.3.4% |

$96,617 |

-0.5% |

Please note, the Uber Cannibals performance assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas the S&P 500 and Small Dogs of the Dow performance assumes that stocks are bought at last close.

Below is the 12-month return of the 2022 Uber Cannibals:

Company |

1 year return |

Assured Guaranty |

-19.6% |

Primerica |

28.0% |

Jack in the Box |

-4.0% |

Navient |

-2.4% |

Discover Financial |

-8.3% |

The New 2023 Uber Cannibals:

The Uber Cannibals portfolio has not been touched since March 2021, when we implemented a heavy bias towards inaction. We now make a trade only if it is a no-brainer to add significant firepower to our buyback arsenal. We have two tweaks that meet that threshold this year: Sell Discover Financial Services and Navient, and invest the proceeds equally into eBay and Toll Brothers.

Here is the resulting 2023 Uber Cannibals portfolio:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- eBay (EBAY)

- Toll Brothers (TOL)

Navient and Discover have been in our portfolio since March 2020. They’ve served us well. Over the last three years, Discover and Navient had an annualized return of 43.7% and 34.3% respectively, vs. the S&P 500 which was up 18.6% annualized.

Ebay and Toll Brothers may be better buyback vehicles from here, however. Ebay has bought back 48% of its shares in the last 5 years and 9% in the last year alone. Toll Brothers has plowed back earnings into share repurchases and bought back 9% of its shares last year.

If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five) and keep that portfolio until April 2024, when I'll provide the 2024 portfolio on www.ChaiWithPabrai.com. Happy Cannibal Investing!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Q&A session at the SumZero Top Stocks Investor Summit on February 9, 2023

Enjoy!

https://www.youtube.com/watch?v=ncYdcZEnH7E

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with London School of Economics on January 18, 2023

Enjoy!

https://www.youtube.com/watch?v=c7Oyv-Echa0

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at JNV Bangalore (Rural) on December 23, 2022

https://www.youtube.com/watch?v=kCTdgDQUoWw

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Session with EO Gurgaon on January 10, 2023

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

2023 Free Lunch Portfolio

The Free Lunch portfolio was down 17.7% in 2022, vs. 17.9% for the S&P 500. The portfolio tracked the S&P 500 in the market sell off this year. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up a paltry 1.6% while the S&P is up 9.5%. The S&P 500 has trounced the Free Lunch portfolio so far. In 2021 we decided to ignore the algorithm’s buy and sell decisions and only make portfolio tweaks if they are no-brainers. This bias towards inaction will avoid disrupting the compounding engine and should help the Free Lunch perform well over time. Since 2021, the Free Lunch portfolio is up 3.0% versus 5.7% for the S&P 500.

Tweaks to the 2023 Free Lunch Portfolio:

This December, we recommend adding Reysas Tasimacilik ve Lojistik Ticaret A.S. (Reysas Logistics) and TAV Havalimanlari Holding A.S. (TAV Airports). We love these businesses and just need to have them in the portfolio. To bring them in, we recommend selling Micron (Cloned Idea) and Berkshire Hathaway (Spawner). The swaps are no-brainers at present prices (the threshold we need to meet to make a change to the portfolio).

Reysas and TAV are both based in Turkey and listed on the Istanbul Stock Exchange. Reysas is a logistics business that owns 62% of Reysas REIT, which in turn owns over 12 million sq. ft of Grade A warehouses in Turkey. It is led by a father-son duo who are fantastic capital allocators. Reysas trades at a steep discount to its liquidation value, and an even steeper discount to intrinsic value. TAV operates 15 airports in 8 countries, and has developed world-class competencies in ground handling, catering, and duty free. The gem in TAV’s portfolio is the Almaty International Airport, which is it recently acquired outright (a rare feat). TAV continues to expand its reach of operations to new airports and is markedly cheaper than other publicly listed airport operators. I discussed investing in Turkey, and specifically Reysas and TAV, in my Q&A Session with YPO Gold Nairobi in Kenya.

It is not easy for US retail investors to buy stocks listed on the Istanbul Stock Exchange, but Fidelity does offer the service to trade Turkish stocks by phone. Once you open an account at Fidelity.com and fund it, you can call Fidelity at +1.800.343.3548, ask for “international trading” and advise the Fidelity representative of your order. Trades are placed in Turkish Lira, so the representative can help you determine the correct number of shares that you can buy with your USD balance, after accounting for possible movements in the Turkish Lira overnight. Trades need to be placed between 5 AM and 7 PM eastern. Limit orders are generally the best way to go. To our knowledge, Fidelity is the only game in town that offers Turkish trading to US retail investors, and it charges a hefty commission (approx. $83 per ticket order). To avoid racking up significant commission charges, you will want limit the number of orders you place and try to maximize the number of shares you buy per ticket order.

In another tweak for the Free Lunch, an existing portfolio holding, Brookfield Corporation, spun-out Brookfield Asset Management, its asset management business in December 2022. As a shareholder of the Brookfield parent, the Free Lunch portfolio automatically received shares in the newly spun out entity. We recommend holding on to the spin-off company: the business has exceptional economics and a long runway.

Here are the constituents for the upcoming year:

Spawners

- TAV Airports (TAVHL.IS)

- Restaurant Brands (QSR)

- Starbucks (SBUX)

- Microsoft (MSFT)

- Brookfield Corp. (BN)

- Brookfield Asset Management (BAM) – a spin-off from Brookfield Corp.

Shameless Cloning

- Reysas Logistics (RYSAS.TI), from Pabrai Funds

- Alphabet (GOOGL), from The Children’s Investment Fund

- Chipotle Mexican Grill (CMG), from Pershing Square

- Alibaba (BABA), from Appaloosa Management

- Tencent (TCEHY), from Value Partners

Uber Cannibals

- Assured Guaranty (AGO)

- Primerica (PRI)

- Navient (NAVI)

- Discover Financial Services (DFS)

- Jack in the Box (JACK)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 16 stocks (i.e., invest the same amount of money in each of these 16) between now and early January 2023. Reysas recently announced its intention to issue a rights offering, which would likely take place in 2-3 months following regulatory approval. To avoid dilution, one should participate in this offering, which will offer existing shareholders the right to purchase shares at TL 1 per share (the current share price is around TL 23). You can invest 90-95 percent of the amount allocated to Reysas today and keep 5-10 percent for the rights offering. Keep your eye out for information on the rights offering from Fidelity.

If you are already invested in the Free Lunch Portfolio, and you rebalanced the Uber Cannibals in April 2022 with the New Uber Cannibals, then sell Micron and Berkshire and invest the proceeds equally between Reysas and TAV. You can do the same 90-95 percent approach with Reysas to allocate the 5-10 percent to the rights offering.

These are the stocks to sell, along with their full-year 2022 returns:

Company |

2022 Return |

Berkshire Hathaway |

3% |

Micron |

-45% |

As a reminder, the new Uber Cannibals get published every April, while the new Spawners and Shameless Cloning businesses are released in January. When we publish the new Uber Cannibals in April 2023, sell the Ubers that are no longer on the new list and invest the proceeds equally across the new Uber Cannibal picks. Then in January 2024, you’ll rebalance the Spawners and Shameless Cloning ideas.

Enjoy!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome. The contents of this website are for educational and entertainment purposes only, and do not purport to be, and are not intended to be, financial, legal, accounting, tax or investment advice. Investments or strategies that are discussed may not be suitable for you, do not take into account your particular investment objectives, financial situation or needs and are not intended to provide investment advice or recommendations appropriate for you. Before making any investment or trade, consider whether it is suitable for you and consider seeking advice from your own financial or investment adviser.

Talk with UNC Business School's Investment Management Club on December 05, 2022

Enjoy!

https://www.youtube.com/watch?v=W--321tO12M

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Speaker Event with Helvetian Investment Club on November 29, 2022

Enjoy!

https://www.youtube.com/watch?v=m606MaKujq4

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session at Nairobi with EO Kenya on October 8, 2022

Enjoy!

If you prefer reading over listening, here is the transcript.

Q&A Session with YPO Gold Nairobi in Kenya on October 11, 2022

Enjoy!

https://www.youtube.com/watch?v=QJNB_CC-PDk

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with students at William & Mary College on November 8, 2022

Enjoy!

https://www.youtube.com/watch?v=j3U0tb-1zSU

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Presentation and Q&A at Boston College and Harvard Business School on Oct 27, 2022

Enjoy!

https://www.youtube.com/watch?v=_h10aNEQK50

with the Presentation slides here.

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with Ironhold Capital on September 16, 2022

Enjoy!

https://www.youtube.com/watch?v=rzXG8pUg4sM

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with Mis Propias Finanzas on September 20, 2022

Enjoy!

https://www.youtube.com/watch?v=rzXG8pUg4sM

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with the Asian Institute of Technology, Bangkok - August 30, 2022

Enjoy!

https://www.youtube.com/watch?v=wz8N5CkTA2w

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Talk with CFA Society of Mexico - August 17, 2022

Enjoy!

https://www.youtube.com/watch?v=MYR0tWgstMI

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Conversation with Lauren Templeton on Zenvesting podcast - July 25, 2022

Enjoy!

https://www.youtube.com/watch?v=E0_K-eFC8bQ

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Lecture at the TiE Austin Speaker Series - Investment & Entrepreneur -August 12, 2022

Enjoy!

https://www.youtube.com/watch?v=gE48QKFGEhI

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Lecture on Approaches to Value Investing - June 16, 2022

Enjoy!

https://www.youtube.com/watch?v=qBdieWfouZM&t=7s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

FINSEC Dialog Conversation - June 1, 2022

Enjoy!

https://www.youtube.com/watch?v=Y2zu_8w_2H0

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Value Investing, Great Compounders, and Lessons from Buffett and Munger - January 5, 2022

Enjoy!

https://www.youtube.com/watch?v=b9ioA0J-p2M&t=34s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A at Harvard Business School Investment Conference - April 2022

Enjoy!

https://www.youtube.com/watch?v=hQsP8ogUp8k

Here is the link to the podcast: If you prefer reading over listening, here is the transcript.

Q&A session with Doctors Investing Group - February 2022

Enjoy!

https://www.youtube.com/watch?v=0SbspUlZW8A&t=389s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

The 2022 Uber Cannibals

We are now ready for the April 2022 Uber Cannibals picks.

Recap of 2021 Uber Cannibals:

As a recap, in my 3/31/17 blog post exactly 5 years ago, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals compounding journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio every year in April. The 2021 Uber Cannibals were:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- Navient (NAVI)

- Discover Financial Services (DFS)

As of 3/31/22, Sonia's $100k was worth $177,379, up 11.5% annualized since inception. If Sonia had instead invested in the S&P 500 over that period, she would be up 16.5% annualized and her portfolio would be worth $222,674. Uber Cannibals was up 15.7% in the last 12 months, vs. 15.6% for the S&P 500. Uber Cannibals has managed to keep up with the S&P 500 for the last 12 months, despite no exposure to high-flying tech names.

Last 12 Months |

Since 1/3/17 |

Value of $100k invested on 1/3/17 |

Since 1/3/17 (annualized) |

|

Uber Cannibals |

15.7% |

77.4% |

$177,379 |

11.5% |

S&P 500 |

15.6% |

122.7% |

$222,674 |

16.5% |

Small Dogs of the Dow |

1.4% |

15.0% |

$115,015 |

2.7% |

Please note, the Uber Cannibals performance assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas S&P 500 and Small Dogs of the Dow performance assumes that stocks are bought at last close.

Below is the 12-month return of the 2021 Uber Cannibals:

Company |

1 year return |

Assured Guaranty |

53.2% |

Primerica |

-6.2% |

Jack in the Box |

-13.3% |

Navient |

23.1% |

Discover Financial |

17.9% |

In the 2021 Uber Cannibals post, I talked about importance of holding on to great compounders and cannibals unless they get egregiously overvalued. In 2022, the algorithms did not serve up any cannibals that would improve the overall quality of the portfolio, and it does not seem that any of our five holdings are egregiously overvalued. So, we do nothing; there are no changes to the 2022 Uber Cannibals. Here are the 2022 Uber Cannibals:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Jack in the Box (JACK)

- Navient (NAVI)

- Discover Financial Services (DFS)

If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five) and keep that portfolio until April 2023, when I'll provide the 2023 portfolio on www.ChaiWithPabrai.com. Happy Cannibal Investing!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Value Investing Masterclass with NUS MBA students at NUS Business School

Enjoy!

https://www.youtube.com/watch?v=dzfjw0ZXVm4

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

2022 Free Lunch Portfolio

The Free Lunch portfolio was up 25% in 2021, vs. 28% for the S&P 500. The portfolio has managed to keep up with S&P 500 despite significant drops in holdings like Alibaba. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up 7% while the S&P is up 17%. While 7% annualized return isn’t so bad, the S&P 500 has trounced the Free Lunch portfolio so far. The Free Lunch does not have much exposure to high-flyers at nosebleed valuations, and quite a few of its names are businesses we know well and are exceptional. Keep the faith. We’re just getting warmed up.

New 2022 Free Lunch Portfolio

Our goal with the Free Lunch is to buy and hold 15 compounders for long stretches of time, giving them plenty of room to ride. It’s a 'set it and forget it' type of portfolio. We’ll make small tweaks only if we come across a business that we love and just need to have in the portfolio. This year we came across one such gem: Tencent Holdings. I’ve given some color on Tencent in a few of my recent talks, including my lecture to Boston College (beginning at 24:08).

To bring in Tencent, we make the tough decision to sell Seritage Growth Properties. Seritage was in the portfolio as a Pabrai Fund pick, even though it wasn’t the top Pabrai Funds holding, which is Micron. We will shift the Pabrai Cloned Idea to Micron. This will leave an open slot. Tencent will fill that slot as a top pick of Value Partners, one of our select value managers based in Hong Kong.

Here are the constituents for the upcoming year:

Spawners

- Berkshire Hathaway (BRK.B)

- Restaurant Brands (QSR)

- Starbucks (SBUX)

- Microsoft (MSFT)

- Brookfield Asset Management (BAM)

Shameless Cloning

- Alphabet (GOOGL), from The Children’s Investment Fund

- Chipotle Mexican Grill (CMG), from Pershing Square

- Micron (Mu), from Pabrai Funds

- Alibaba (BABA), from Appaloosa Management

- Tencent (TCEHY), from Value Partners

Uber Cannibals

- Assured Guaranty (AGO)

- Primerica (PRI)

- Navient (NAVI)

- Discover Financial Services (DFS)

- Jack in the Box (JACK)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 15 stocks (i.e., invest the same amount of money in each of these 15) between now and early January 2022.

If you are already invested in the Free Lunch Portfolio, and you rebalanced the Uber Cannibals in April 2021 with the New Uber Cannibals, then sell Seritage and invest the proceeds in Tencent. You can do this in early January 2022.

If you’re investing in a taxable account, you may try to sell Seritage in December 2021 to capture short-term losses.

These are the stocks to sell, along with their full-year 2021 returns:

Stock |

2021 Return |

Seritage Growth Properties |

-9% |

As a reminder, the new Uber Cannibals get published every April, while the new Spawners and Shameless Cloning businesses are released in January. When we publish the new Uber Cannibals in April 2022, sell the Ubers that are no longer on the new list and invest the proceeds equally across the new Uber Cannibal picks. Then in January 2023, you’ll rebalance the Spawners and Shameless Cloning ideas.

Enjoy!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Q&A session with students at the University of Georgia - November 2021

Enjoy!

https://www.youtube.com/watch?v=wT1m8J4hdpA&t=852s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at William & Mary College - October 26, 2021

Enjoy!

https://www.youtube.com/watch?v=-etUrauRHgE&t=957s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with students at the University of Oxford - October 19, 2021

Enjoy!

https://www.youtube.com/watch?v=PN3f668IKO0&t=1s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

My Annual Talk at Boston College - October 14, 2021

Enjoy!

https://www.youtube.com/watch?v=_7UfqjD3IEg&t=2s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with Brown University Value Investing Speaker Series - August 2, 2021

Enjoy!

https://www.youtube.com/watch?v=p5xt09gAi-U&t=404s

If you prefer reading over listening, here is the transcript.

Q&A with Value School (Madrid, Spain) - July 9, 2021

We talked about investing in developing markets and how my investment philosophy changed over the years.

https://www.youtube.com/watch?v=cJGkrSFVnns

Here is the link to the podcast: If you prefer reading over listening, here is the transcript.

Q&A Session with Vishal Khandelwal

https://www.youtube.com/watch?v=NfcGzvXAw6M

| The One Percent Podcast - Mohnish Pabrai - Transcript |

In Conversation With Ajay Antony, Founder & Teacher, The Physics Chamber

Enjoy!

https://www.youtube.com/watch?v=YSAtJd7iJV8

Q&A Session with London Business School MBA Students - May 19, 2021

Enjoy!

https://www.youtube.com/watch?app=desktop&v=K4mggdrMHVo

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with The Kolkata Value Hunters Club - May 12, 2021

Enjoy!

https://www.youtube.com/watch?app=desktop&v=9JYXICM3RSo&t=2804s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A session with OMAHA - May 20, 2021

Enjoy!

https://www.youtube.com/watch?v=V9T3dEeWiVE

The Investors Podcast - May 1, 2021

We talked about a new investment framework and how retail investors can clone it.

Enjoy!

https://podcasts.apple.com/us/podcast/tip347-value-investing-in-2021-w-mohnish-pabrai/id928933489?i=1000519670433

2021 Virtual Value Investing Conference

Enjoy!

https://www.youtube.com/watch?app=desktop&v=OmrVUxTGENw

Q&A Session with MBA Students at Columbia Business School – March 18, 2021

Enjoy!

https://www.youtube.com/watch?v=NEB2RfRgBSQ

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with Students at Indiana Univ. Kelley School of Business –April 1, 2021

Enjoy!

https://www.youtube.com/watch?v=XNtWcAag9as

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

The 2021 Uber Cannibals

We are now ready for the April 2021 Uber Cannibal picks.

Recap of 2020 Uber Cannibals:

As a recap, in my 3/31/17 blog post, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals compounding journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio every year in April. The 2020 Uber Cannibals were:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Globe Life (GL)

- Navient (NAVI)

- Discover Financial Services (DFS)

As of 3/30/21, Sonia's $100k was worth $154,116 (after trading costs), up 10.7% annualized since inception. If Sonia had instead invested in the S&P 500 over that period, she would be up 16.6% annualized and her portfolio would be worth $191,838.

During the COVID-driven market sell off in the first three months of 2020, Sonia's portfolio was down 40.8%, while the S&P 500 was down 18%. She kept the faith and hung on. From April 1, 2020 through today, Sonia's portfolio is up 73%, vs. 55.8% for the S&P 500. The Uber Cannibals 5-stock portfolio is far more concentrated than the indices and will be more volatile. The Uber Cannibals strategy makes sense if you intend to follow it for at least a decade or two (or longer). Sonia’s in it for the long-run.

|

|

Last

12 Months |

Since

1/3/17 |

Since

1/3/17 (Annualized) |

Value

of $100k invested on 1/3/17 |

|

Uber

Cannibals |

73.0% |

54.1% |

10.7% |

$154,116 |

|

S&P

500 |

55.8% |

91.8% |

16.6% |

$191,838 |

|

Small Dogs

of the Dow |

41.7% |

35.4% |

7.4% |

$135,395 |

Please note, the Uber Cannibals performance includes trading costs and assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas S&P 500 and Small Dogs of the Dow performance does not include trading costs and assumes that stocks are bought at last close.

Below is the 12-month return of the 2020 Uber Cannibals:

|

Company |

1 year return |

|

Assured Guaranty |

47.4% |

|

Primerica |

64.7% |

|

Globe Life |

32.5% |

|

Navient |

76.0% |

|

Discover Financial Services |

153.4% |

A key lesson I learned in 2020 was to hold on to great compounders and cannibals (unless they get egregiously overvalued). I discussed this in more detail at a Manual of Ideas session earlier this year. Moving forward, at the April rebalance, we will assess the new Uber Cannibal picks that the algorithms recommend we swap into the portfolio. However, we will only make changes if the new businesses improve the overall quality of the portfolio. Otherwise, we will stay long and strong. Here are the 2021 Uber Cannibals:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Navient (NAVI)

- Discover Financial Services (DFS)

- Jack in the Box (JACK)

Sell Globe Life from the 2020 Uber Cannibals and invest the proceeds in Jack in the Box. If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five) and keep that portfolio until April 2022, when I'll provide the 2022 portfolio on www.ChaiWithPabrai.com. Happy Cannibal Investing! If you invested in the Uber Cannibals in April 2020 in a taxable account, try to sell after 366 days, to realize long term gains.

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Q&A Session with MBA Students at Georgetown University – March 4, 2021

Enjoy!

https://www.youtube.com/watch?v=V_djW_RGPGA&t=400s

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with members of The Babson College Fund (Babson College Students)– Feb 9, 2021

Enjoy!

https://www.youtube.com/watch?v=NXxIQfVIzVU

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A with students of Peking Univ. (Guanghua School of Mgmt.)–Dec. 3, 2020

The presentation included a rich Q&A session on a diverse set of topics. Enjoy!

https://www.youtube.com/watch?app=desktop&v=pUiwBs_N5cE

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with Students at Clemson University - Jan 27, 2021

Enjoy!

https://www.youtube.com/watch?v=QIUH0IzoV6E

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Value Investing with Legends Podcast - The Value of Continuous Learning

Enjoy!

Apple Podcasts: shorturl.at/vyWY8

Spotify: https://open.spotify.com/episode/30t6eKvL47rARxwhHUJmCY

Google Podcasts: shorturl.at/iF689

2021 Free Lunch Portfolio

The Free Lunch portfolio was up just 3% in 2020, vs. 16% for the S&P 500. Although the portfolio fell 37% in the Covid-driven sell-off in Q1 2020, it has since recovered meaningfully. Since April 2020, the Free Lunch is up 64% vs. 45% for the S&P 500. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up a very modest 1% while the S&P is up 13%. The S&P 500 has trounced the Free Lunch portfolio so far. But, three years is also a very short duration. With bubblesque additions like Tesla and overheated valuations, I think the S&P 500 may have a few challenging years ahead.

Holding on to Compounders and Spawners

The Free Lunch’s underlying strategy is a sound one. It biases the portfolio towards businesses that generate (and return) a lot of cash and have wide moats. Over the years, the algorithm has picked up stakes in exceptional businesses, including NVR, Alibaba, Alphabet (Google), Micron Technology, Chipotle and Berkshire Hathaway. The algorithm is a great stock picker. However, it tends to sell businesses that are Compounders, Uber Cannibals, or Spawners way too early. This leaves money on the table and stunts the power of long-term compounding.

Take NVR as an example. NVR is an asset-light U.S. homebuilder that builds pre-sold homes. It has a low-risk business model that generates a ton of cash. At NVR, buying back shares is religion. For 25 years, management has used every penny of excess cash to buy back stock, and they have have bought back a mind-blowing 75%+ of their shares outstanding! Mr. Market has rewarded this Uber Cannibal handsomely as a result. An investment of $1,000 in NVR in 1995 would be worth $413,500 today. In January 2018, the Free Lunch picked NVR, which it promptly (and incorrectly) sold in the April 2018 rebalance.

The Free Lunch strategy is also very good at selecting Spawners, which are businesses that persistently add and incubate related and unrelated businesses. These have the potential to be massive growth engines. The Free Lunch has invested in exceptional Spawners over the years, including Alibaba, Alphabet and Berkshire Hathaway. But it has also sold too early. In January 2018, the Free Lunch picked Alibaba, which it (incorrectly) sold 12 months later.

New 2021 Free Lunch Portfolio

As a result of this introspection, we have made three key changes to the Free Lunch approach. First, although we will continue to leverage the algorithm as a stock picking tool in December and April of every year, we will not automatically follow its buy and sell decisions. We will only make changes if doing so improves the quality of the portfolio. Second, we have replaced the Spin-Offs bucket with Spawners, because they are superior businesses to buy and hold. Third, we will not be required to select 5 businesses from each of the three buckets. The number from each bucket will depend on the businesses that the algorithm offers. We want to invest in compounders, not buckets.

We will continue to evaluate the Spawners and Shamelessly Cloned Ideas in December of every year, and the Uber Cannibals in April.

Here are the constituents for the upcoming year:

Spawners

- Berkshire Hathaway (BRK.B)

- Restaurant Brands (QSR)

- Starbucks (SBUX)

- Microsoft (MSFT)

- Brookfield Asset Management (BAM)

Shameless Cloning

- Alphabet (GOOGL), from The Children’s Investment Fund

- Chipotle Mexican Grill (CMG), from Pershing Square

- Micron (MU), from Himalaya Capital

- Alibaba (BABA), from Appaloosa Management

- Seritage Growth Properties (SRG), from Pabrai Funds

Uber Cannibals

- Assured Guaranty (AGO)

- Primerica (PRI)

- Globe Life (GL)

- Navient (NAVI)

- Discover Financial Services (DFS)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 15 stocks (i.e., invest the same amount of money in each of these 15) between now and early January 2021.

If you are already invested in the Free Lunch Portfolio, and you rebalanced the Uber Cannibals in April 2020 with the New Uber Cannibals, then sell all of the 2020 Spinoffs and Shamelessly Cloned businesses except Alphabet, Berkshire Hathaway, and Chipotle, and invest the proceeds equally among the 6 new kids. You can do this in early January 2021.

If you’re investing in a taxable account, you may try to sell the losers (Citigroup, Hilton Grand Vacations, Athene Holdings, RMR Group and Vectrus) in December 2020 to capture short-term losses and sell the winners (Fiat Chrysler and FirstService) in early January 2021 to capture long-term gains.

These are the stocks to sell, along with their full-year 2020 returns:

Company |

2020 Return |

Citigroup |

-21% |

RMR Group |

-12% |

Hilton Grand Vacations |

-11% |

Athene Holding |

-10% |

Vectrus |

-7% |

Fiat Chrysler Automobiles |

21% |

FirstService |

44% |

Enjoy!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

Mohnish Pabrai Presentation and Q&A with UCLA Student Investment Fund - November 5, 2020

Enjoy!

https://www.youtube.com/watch?v=iJII3_CyUvo

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Mohnish Pabrai Lecture at Boston College (Carroll School of Mgmt) - October 8, 2020

Enjoy!

https://www.youtube.com/watch?v=ANn907GgLPs&feature=youtu.be

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Q&A Session with Edelweiss Asset Management - May 29, 2020

https://www.youtube.com/watch?v=nogBvLWB6cU&feature=youtu.be

If you prefer reading over listening, here is the transcript.

Q&A Session with Millennium Mams' - May 8, 2020

https://www.youtube.com/watch?v=_2aFw40NqP8

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Fireside Chat with Jeff Pintar - May 21, 2020

https://www.youtube.com/watch?v=w2hnOllfpwI

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

The Investors Podcast - May 2, 2020

We talked about biases in life and investing, pre-investment checklists and hidden moat businesses. We also discussed Dakshana Foundation and approaching philanthropy with an investor’s mindset.

Enjoy!

https://link.chtbl.com/WSB295

CNBC India Interview, April 27, 2020

Stay healthy and safe!

https://www.cnbctv18.com/videos/market/wizards-of-dalal-street-eminent-value-investor-mohnish-pabrai-on-covid-19-and-world-economy-5785031.htm

Q&A Session with Francis Chou at Harvard – April 7, 2020

Here is the video: https://youtu.be/iW0Mv9zVt0o

Here is the link to the podcast:

- Google Podcasts

- Apple Podcasts

- Spotify

- If you prefer reading over listening, here is the transcript.

Mohnish Pabrai: A Bull’s View in a Virus Shop

I hope you are staying healthy and safe. The battle against the Coronavirus is extracting a high toll, but humans will prevail. This too shall pass.

https://sumzero.com/headlines/business_services/468-mohnishprabai?fbclid=IwAR3jidhmXadv-Kl-kUKKpHCZ6tLV1EIlj8TeC4aG2pvFz5fYzBX__R-i0BE

The New 2020–2021 Uber Cannibals

We are now ready for the April 2020 picks.

Recap of 2019 Uber Cannibals:

As a recap, in my 3/31/17 blog post, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals investing journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio annually in April. The 2019 - 2020 Uber Cannibals were:

- Sleep Number (SNBR)

- Corning (GLW)

- Asbury Automotive Group (ABG)

- Quanta Services (PWR)

- Allison Transmission Holdings (ALSN)

As of 3/30/20, Sonia's $100k was worth $90,609 (after trading costs), down 9.4%. If Sonia had instead invested in the S&P 500 over that period, she would be up 25.1% and her portfolio would be worth $125,142. Uber Cannibals were down 34% over the last 12 months and the S&P was down 6%.

Sonia's portfolio fell considerably in the Coronavirus-driven market sell off in the first few months of 2020. As of 12/31/19, Sonia's portfolio was neck-and-neck with the S&P 500, with her $100k worth $153,400 (after trading costs), up 53.4% since inception, while the same investment in the S&P 500 was worth $153,200, up 53.2%. Since then, Sonia's portfolio has fallen 40.8% year-to-date in 2020, while the S&P 500 has fallen 18%. The Uber Cannibals 5-stock portfolio is far more concentrated than the indices, so our lag here is not surprising. Over time, the Uber Cannibals portfolio should recoup these losses and then some. The Uber Cannibals strategy makes sense if you intend to follow it for at least a decade or two (or longer).

|

|

Last 12 Months |

Since 1/3/17 |

Value of $100k invested on 1/3/17 |

April 2019 - Dec 2019 |

Inception till Dec 2019 |

YTD 2020 |

|

Uber Cannibals |

-33.7% |

-9.4% |

$90,609 |

12.3% |

53.4% |

-40.8% |

|

S&P 500 |

-5.5% |

25.1% |

$125,142 |

15.7% |

53.2% |

-18.3% |

|

Small Dogs of the Dow |

-25.2% |

-4.1% |

$95,922 |

-2.0% |

25.7% |

-23.7% |

Please note, the Uber Cannibals performance includes trading costs and also assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas S&P 500 and Small Dogs of the Dow performance does not include trading costs and assumes that stocks are bought at last close.

Below is the 12-month return of the 2019-2020 Uber Cannibals:

|

Company |

1 year return |

|

Sleep Number Corp. |

-55.8% |

|

Corning Inc. |

-33.8% |

|

Asbury Automotive Group |

-20.3% |

|

Quanta Services |

-18.8% |

|

Allison Transmission Holdings |

-25.0% |

We made a few tweaks to the Uber Cannibals strategy that will be implemented in this rebalance. The changes are summarized below:

- Insurance companies are allowed to enter the portfolio.

- We no longer have Price to Sales ratio or Share Buyback over the dividend yield ratio as a screening condition.

- We added a new quality condition and now select the top 5 Uber Cannibals with the highest five year average return on invested capital (ROIC).

- Existing Uber Cannibals in the portfolio that have shown a consistent commitment to buybacks over the time get a preference during the selection process.

For 2020 - 2021, our algorithms selected the following five Uber Cannibals:

- Assured Guaranty (AGO)

- Primerica (PRI)

- Globe Life (GL)

- Navient (NAVI)

- Discover Financial Services (DFS)

The five-stock Uber Cannibals strategy can be combined with the five-stock Shameless Cloning and Spinoffs strategies into the 15-stock Free Lunch Portfolio. While the Uber Cannibals rebalance in April, the Shameless Cloning and Spinoffs rebalance in December. You can find the 2020 picks for Shameless Cloning and Spinoffs in my post from December 2019.

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

2020 Free Lunch Portfolio

Uber Cannibals

- Corning (GLW)

- Discover Financial Services (DFS)

- Lear (LEA)

- PulteGroup (PHM)

- Sleep Number (SNBR)

Shameless Cloning

- Alphabet (GOOGL), from Sequoia Fund

- Berkshire Hathaway (BRK.B), from Markel Insurance

- Charter Communications (CHTR), from TCI Fund Management

- Citigroup (C), from ValueAct Capital

- Micron Technology (MU), from Appaloosa Management

Spinoffs

- Delphi Technologies (DLPH)

- DXC Technology (DXC)

- Hamilton Beach Brands Holding (HBB)

- Hilton Grand Vacations (HGV)

- Varex Imaging (VREX)

The Free Lunch portfolio was up 21.7% in 2019, vs. 31.2% for the S&P 500. Since inception on January 1, 2018, on an annualized basis, the Free Lunch portfolio is up 0.01% while the S&P is up 12.0%.

The Free Lunch is only 2 years old, so we can't draw any meaningful conclusions about its long-term performance yet. These are early days. Keep the faith. This is a long-term "set it and forget it" strategy. We don't recommend putting more than 10-20% of your nest egg into this strategy. And we think it only makes sense if you follow it for a decade, or two, or longer. Ideally, you would use this strategy in your IRA, so you wouldn't have to worry about realized gains.

The New 2020 Free Lunch Portfolio

We are now ready to rebalance the Free Lunch Portfolio for 2020. We made a few changes to the Shameless Cloning and Spinoffs strategies that we believe can select better companies and improve future performance. The changes are summarized below:

Shameless Cloning:

- We replaced Greenlight Capital with Pershing Square Capital Management on the list of managers whom we shamelessly clone.

- We tightened the Price/ Sales Ratio entry condition from a P/S of less than 3 to a P/S of less than 2.

- We changed the credit rating requirement so that now both the parent company and its spinoff must meet the minimum credit rating threshold at the spinoff’s entry into the portfolio. If the spinoff experiences any credit rating downgrade since IPO, it is removed.

- We added a new quality condition and now select the top 5 spinoffs with the highest trailing 12-month return on invested capital (ROIC).

Here are the constituents for the upcoming year:

Uber Cannibals

- Allison Transmission Holdings (ALSN)

- Asbury Automotive Group (ABG)

- Corning (GLW)

- Quanta Services (PWR)

- Sleep Number (SNBR)

Shameless Cloning

- Alphabet (GOOGL), from Sequoia Fund

- Berkshire Hathaway (BRK.B), from Markel Insurance

- Chipotle Mexican Grill (CMG), from Pershing Square

- Citigroup (C), from ValueAct Capital

- Fiat Chrysler Automobiles (FCAU), from Pabrai Funds

Spinoffs

- Athene Holding (ATH)

- FirstService (FSV)

- Hilton Grand Vacations (HGV)

- RMR Group (RMR)

- Vectrus (VEC)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 15 stocks (i.e., invest the same amount of money in each of these 15) in early January 2020.

If you are already invested in the Free Lunch Portfolio, and you rebalanced the Uber Cannibals in April 2019 with the New Uber Cannibals, then sell all of the 2019 Spinoffs and Shamelessly Cloned businesses except Alphabet, Berkshire Hathaway, Citigroup and Hilton Grand Vacations, and invest the proceeds equally among the 6 new kids. You can do this in early January 2020.

If you're investing in a taxable account, you may try to sell the losers (Hamilton Beach Brands Holding, DXC Technology and Delphi Technologies) in December 2019 to capture short-term losses and sell the winners (Charter Communications, Micron Technology and Varex Imaging) in early January 2020 to capture long-term gains.

These are the stocks to sell, along with their full-year 2019 returns:

|

Bucket |

Stock |

2019 Return |

|

Shameless

Cloning |

Charter

Communications |

75% |

|

Shameless

Cloning |

Micron

Technology |

69% |

|

Spinoffs |

Varex Imaging |

27% |

|

Spinoffs |

Delphi

Technologies |

-7% |

|

Spinoffs |

Hamilton

Beach Brands Holding |

-19% |

|

Spinoffs |

DXC

Technology |

-28% |

Enjoy!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

My Annual Talk at Boston College

Enjoy!

https://www.youtube.com/watch?v=kdGltV0eomU&feature=youtu.be

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview for Graham & Doddsville Newsletter, Columbia Business School

The interview starts on Page 22:

https://www8.gsb.columbia.edu/valueinvesting/sites/valueinvesting/files/files/Graham%26Doddsville_Issue37.pdf

Enjoy!

MOI Global’s Meet-the-Author Summer Forum 2019 Interview

Enjoy.

https://www.youtube.com/watch?time_continue=106&v=OgsKhFzyX2U

If you prefer reading over listening, here is the transcript:

https://moiglobal.com/mohnish-pabrai-the-dhandho-investor-201907/

Lecture and Q&A with Students of Peking Univ. (Guanghua School of Mgmt.) – May 1, 2019

The presentation included a rich Q&A session on a diverse set of topics. Enjoy!

https://www.youtube.com/watch?v=Kax8XnBU1ik

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Trinity College Dublin Talk - February 21, 2019

https://www.youtube.com/watch?v=_0XPurSI9cQ

Enjoy!

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

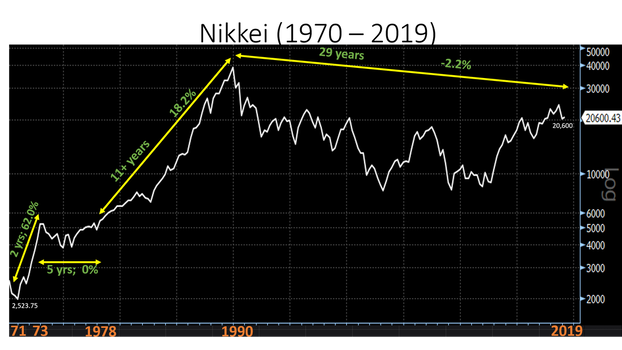

Update: The video inadvertently uses a wrong Nikkei chart at 18:46. Below is the correct chart:

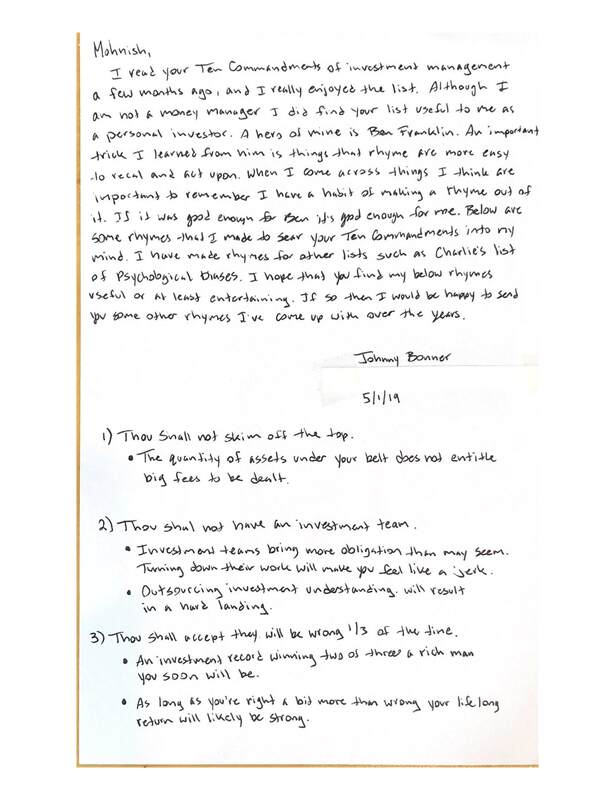

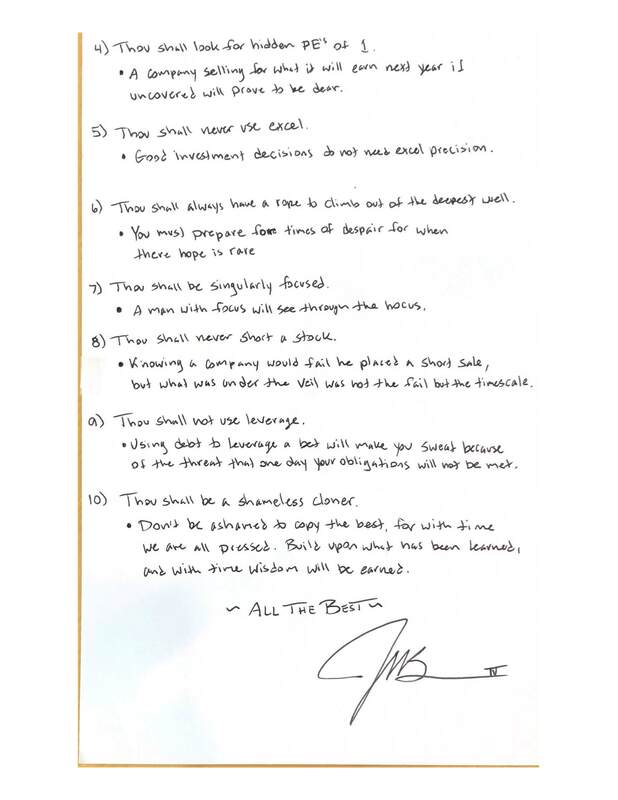

An Ode to the Ten Commandments of Investment Management

Enjoy!

| Johnny Bonner's ode to Ten Commandments Page 1.jpg |

| Johnny Bonner's ode to Ten Commandments Page 2.jpg |

The Investor’s Podcast

Enjoy!

https://www.theinvestorspodcast.com/episodes/tip241-value-investing-w-mohnish-pabrai/

GuruFocus Podcast Interview

Enjoy!

https://www.gurufocus.com/podcast.php (Episode 12)

If you prefer reading over listening, here is the transcript:

https://www.gurufocus.com/news/837804/transcript-mohnish-pabrai-interview-with-gurufocus--finding-value-in-india-and-the-us

Q&A session with Dakshana Scholars at Dakshana Valley, Dec. 26, 2018

Enjoy!

https://www.youtube.com/watch?v=BUolYZTqiiI&feature=youtu.be

Q&A session with Dakshana Scholars at JNV Kottayam, Dec. 24, 2018

Enjoy!

https://www.youtube.com/watch?v=jRcLBGHsBpw

The New 2019–2020 Uber Cannibals

We are now ready for the April 2019 picks.

Recap of 2018 Uber Cannibals:

As a recap, in my 3/31/17 blog post, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals investing journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio annually in April. The 2018 - 2019 Uber Cannibals were:

- Sleep Number Corp. (SNBR)

- Corning Inc. (GLW)

- PulteGroup (PHM)

- Discover Financial Services (DFS)

- Lear Corp. (LEA)

As of 3/29/19, Sonia's $100k was worth $136,656 (after trading costs), up 36.7%. If Sonia had instead invested in the S&P 500 over that period, she would be up 32.4% and her portfolio would be worth approx. $4k less, or $132,389.

Please note, Uber Cannibals performance includes trading costs and also assumes that stocks are bought at the high price of the day and sold at low price of the day, whereas S&P 500 and Small Dogs of the Dow performance does not include trading costs and assumes that stocks are bought at last close.

|

Last 12 Months |

Since 1/3/17 |

Value of $100K invested

on 1/3/17 |

|

|

Uber Cannibals |

4.1% |

36.7% |

$136,656 |

|

S&P 500 |

9.5% |

32.4% |

$132,389 |

|

Small Dogs of the Dow |

19.4% |

28.3% |

$128,288 |

Corning, PulteGroup, Discover and Lear paid dividends totaling $1,950. Per our rules, Sonia reinvested those dividends back into the same businesses.

Below is the 1 year return of the 2018-2019 Uber Cannibals:

|

Company |

1 year return |

|

Sleep Number Corp. |

33.7% |

|

Corning Inc. |

21.6% |

|

PulteGroup |

-3.8% |

|

Discover Financial Services |

1.0% |

|

Lear Corp. |

-25.8% |

The New Uber Cannibals:

For 2019 - 2020, our algorithms selected the following five Uber Cannibals:

- Sleep Number Corp. (SNBR)

- Corning Inc. (GLW)

- Asbury Automotive Group Inc. (ABG)

- Quanta Services Inc. (PWR)

- Allison Transmission Holdings Inc. (ALSN)

Sleep Number Corp. (for the second time in a row) and Corning Inc. will continue to be in the portfolio for yet another year. But we have three new kids on the block.

If you invested in the Uber Cannibals in April 2018, then leave Sleep Number Corp and Corning untouched, and sell PulteGroup, Discover and Lear Corp. Then invest the proceeds equally among the three new kids: Asbury Automotive, Quanta Services, and Allison Transmission Holdings.

If you invested in the Uber Cannibals in April 2018 in a taxable account, try to sell the winner (currently Discover Financial Services) after holding it for at least 366 days and the losers (PulteGroup and Lear Corp) after no more than 364 days.

If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five) and keep that portfolio until April 2020, when I'll provide the 2020 - 2021 portfolio on www.ChaiWithPabrai.com. Happy Cannibal Investing!

The five-stock Uber Cannibals strategy can be combined with the five-stock Shameless Cloning and Spinoffs strategies into the 15-stock Free Lunch Portfolio. While the Uber Cannibals rebalance in April, the Shameless Cloning and Spinoffs rebalance in December. You can find the 2019 picks for Shameless Cloning and Spinoffs in my post from December 2018.

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

2019 Free Lunch Portfolio

Uber Cannibals

- Lowe’s Companies (LOW)

- NVR (NVR)

- Sleep Number (SNBR)

- The Hackett Group (HCKT)

- Willis Lease Finance (WLFC)

Shameless Cloning

- Alibaba Group Holding (BABA)

- British American Tobacco (BTI)

- Fiat Chrysler Automobiles (FCAU)

- General Motors (GM)

- Micron Technology (MU)

Spinoffs

- Adient (ADNT)

- CSRA (CSRA)

- GCP Applied Technologies (GCP)

- Lamb Weston Holdings (LW)

- Synchrony Financial (SYF)

The Free Lunch portfolio was down 17% in 2018, vs. -2.9% for the S&P 500. Our backtests show that the Free Lunch Portfolio outperforms the S&P 500 over a 17+ year period (17.1% annualized for the Free Lunch vs. 5.4% for the S&P 500), but it does not do so every year. In fact, the Free Lunch Portfolio underperformed in 6 out of the 17 years we tested.

Keep the faith and do not overreact to short-term negative performance. This is a long-term “set it and forget it” strategy. We don’t recommend putting more than 10-20% of your nest egg into this strategy. And we think it only makes sense if you follow it for a decade, or two, or longer. Ideally, you would use this strategy in your IRA, so you wouldn’t have to worry about realized gains.

The New 2019 Free Lunch Portfolio

We are now ready to rebalance the Free Lunch Portfolio for 2019. Here are the constituents for the upcoming year:

Uber Cannibals

- Corning Inc. (GLW)

- PulteGroup (PHM)

- Sleep Number (SNBR)

- Discover Financial Services (DFS)

- Lear Corp. (LEA)

Shameless Cloning

- Charter Communications (CHTR) – From TCI Fund Management

- Citi Group (C) – From ValueAct Capital

- Micron Technology (MU) – From Appaloosa Management

- Alphabet (GOOGL) – From Sequoia Fund

- Berkshire Hathaway (BRK.B) – From Markel Insurance

Spinoffs

- Hamilton Beach Brands Holding (HBB)

- DXC Technology (DXC)

- Varex Imaging Corp. (VREX)

- Hilton Grand Vacations (HGV)

- Delphi Technologies (DLPH)

If you are a new investor to the Free Lunch Portfolio, you can just equal weight these 15 stocks (i.e., invest the same amount of money in each of these 15) in early January 2019.

If you invested in the Free Lunch Portfolio at the beginning of 2018 and rebalanced the Uber Cannibals in April 2018 when we published the New Uber Cannibals, then you would sell all of the 2018 Spinoffs and Shameless Cloning companies except for Micron, and invest the proceeds equally among the 9 new kids. You can do this in early January 2019 (or now if you’re investing in a taxable account and you’d like to capture losses for 2018).

As a reminder, the Uber Cannibals get published for rebalancing every April, while the Spinoffs and Shameless Cloning ideas rebalance in January. When we publish the new Uber Cannibals in April 2019, sell the Ubers that are no longer on the new list and invest the proceeds equally across the new Uber Cannibal picks. Then in January 2020, you’ll rebalance the Spinoffs and Shameless Cloning ideas.

Enjoy!

Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome.

ET Now Interview with Guy Spier over Chai and Vada Pav

Enjoy!

https://www.youtube.com/watch?time_continue=17&v=OTvzQR9KKT8

Q&A session with Dakshana Scholars at Dakshana Valley, Oct. 21, 2018

The Q&A session is in Hindi. Enjoy!

https://www.youtube.com/watch?v=NrDLcZHkf3I&t=6s

Here is the link to the podcast:

Keynote Speech at Annual Morningstar India Conference - Oct. 24, 2018

https://www.youtube.com/watch?v=5XJ88nRtF0I

Here is the link to the podcast: If you prefer reading over listening, here is the transcript.

Interview with CNBC – TV18 on Investing Opportunities in India

It is a two-part interview:

Part1: https://www.youtube.com/watch?v=rP5Wow-Xpgw

Part2: https://www.youtube.com/watch?v=Ke6GCMixqMc

The Ten Commandments of Investment Management

https://youtu.be/9tGjXPhnp-s

Enjoy!

Here is an Economic Times article on the talk:

https://economictimes.indiatimes.com/markets/stocks/news/pabrais-10-commandments-for-becoming-a-successful-investor/articleshow/67123851.cms

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Economic Times Interview: Volatility is the Friend of a Long-term Investor

Enjoy!

https://economictimes.indiatimes.com/markets/expert-view/volatility-is-the-friend-of-a-long-term-investor-mohnish-pabrai/articleshow/65570377.cms

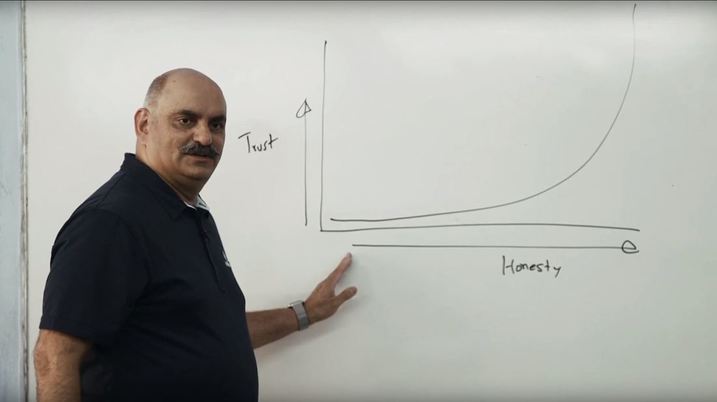

The Trust vs. Truth Talk at JNV Bundi (Rajasthan) on June 2, 2018

We explored the variables Buffett believes are key to success in life (integrity, intelligence, and energy), Marcus Aurelius’ Stoicism and the importance of adversity, and the motivations behind establishing the Dakshana Foundation.

Enjoy!

https://www.youtube.com/watch?v=j72nRsSPIi0&feature=youtu.be

Interview for the Leadership show

http://www.populis.com.au/single-post/2018/06/21/CLEVER-INVESTOR-AND-GIVER-Rohilesh-X-Mohnish-Pabrai

https://www.youtube.com/watch?v=m53ukJMuO78

Mohnish Pabrai Lecture at Univ. of California, Irvine (UCI), June 7, 2017

Enjoy!

https://www.youtube.com/watch?v=bLjoL5zhBxA

Here is the link to the podcast:

If you prefer reading over listening, here is the transcript.

Interview with SumZero in Forbes – Advice for Value Investors

Enjoy!

https://www.forbes.com/sites/kevinharris/2018/06/25/mohnish-pabrais-advice-for-value-investors/#60ce25d122ed

Your deepest desire is your destiny (The Upanishads)

Enjoy!

https://www.youtube.com/watch?v=jjjI5O_uZUA

Chai With Pabrai: ET Now Interview

Enjoy!

https://www.youtube.com/watch?v=T7Qr1Ze8vNA

Lecture at Columbia Business School: “Where have we been and where are we headed?”

Enjoy!

It is best to watch the video using the Firefox browser. It may take a few minutes to load. You may want to turn up the volume for better audio. You can toggle between the slides and the video by clicking on the box in the bottom right of your screen:

https://echo360.org/media/80cb039a-ded1-4395-a673-6b548ab27ea4/public

ET Now Interview at Berkshire Hathaway Annual Meeting

Enjoy!

https://www.youtube.com/watch?v=7FspBQlgu88&app=desktop

Talk With Class of 2019 Dakshana Scholars – Dec. 24, 2017

Enjoy!

https://www.youtube.com/watch?v=jqX9AgwgwTY&feature=youtu.be

I suggest the following books to start one's journey into finance and investing:

1) 1958-1970 Buffett Partnership Letters (these are available at various places on the web, including http://pragcap.com/warren-buffett-partnership-letters). Cost: Zero

2) The Warren Buffett letters to Berkshire Hathaway Shareholder. These are posted at www.berkshirehathaway.com. Cost: Zero

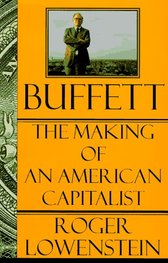

3) 1995 published biography called “Buffett: The Making of an American Capitalist” by Roger Lowenstein.

4) 2009 published book “Snowball: Warren Buffett and the Business of Life” by Alice Schroeder.

5) “Poor Charlie’s Almanack” by Peter Kaufman.

6) “The Dhandho Investor” by Mohnish Pabrai.

7) Berkshire Hathaway Letters to Shareholders - 1965-2014

8) Berkshire Hathaway Letters to Shareholders - 1965-2017. Only available on Kindle but cost is just $2.99.

Patel's Business Secrets - Video On the Dhandho Investor

https://www.youtube.com/watch?v=INSuLnQJvuY&feature=youtu.be&a

Enjoy!

The New 2018–2019 Uber Cannibals