|

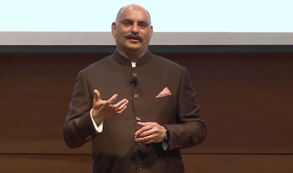

I thoroughly enjoyed going back to the University of California, Irvine to give my 2nd annual UCI lecture entitled, “Few Bets. Big Bets. Infrequent Bets.”

I discussed five decisions by Warren Buffett and Charlie Munger made over a 20-year period (1968 – 1988) that moved the needle for Berkshire. I also delved into the intense difficulties that Charlie Munger faced along the way. No pain, no gain. The presentation was followed by a rich Q&A on a diverse range of topics. Enjoy! https://www.youtube.com/watch?v=bLjoL5zhBxA

22 Comments

Padmakar Shetty

7/14/2017 06:30:43 pm

It was a great lesson for value investing.The pick from the talk r minimize risk, Stay with your circle of competence,Wait for the right pitch , Create competitive advantage.Mohnish is true disciple of Great Warren & Charlie Munger & lovely human being.Tku

Reply

Mohnish Pabrai

10/27/2017 05:26:11 pm

Thanks for the nice note Padmakar.

Reply

7/23/2017 06:25:33 pm

Keep sharing the ideas

Reply

Mohnish Pabrai

10/27/2017 05:26:56 pm

Thanks for the nice note Mishra.

Reply

7/29/2017 08:35:26 pm

Thank you for sharing your wisdom with us all. Are these talks open to the public? I live in Newport Beach and would love to attend the next one if possible.

Reply

Mohnish Pabrai

10/27/2017 05:29:15 pm

Thanks for the nice note Lukas. Yes, they are open to the public.

Reply

Hi Mohnish

Reply

Mohnish Pabrai

10/27/2017 05:29:47 pm

Thanks for the nice note Eswaran.

Reply

sp

9/7/2017 07:41:47 am

great

Reply

Mohnish Pabrai

10/27/2017 05:30:10 pm

Thanks for the nice note.

Reply

7/7/2018 05:37:59 am

Government of Telangana state is providing financial assistance to the Scheduled Caste, Scheduled Tribe, Backward Class, Disabled, and Economically Backward Class students studying post-matriculation courses on saturation approach to enable them to complete their education.

Reply

5/11/2021 04:53:22 am

<a href="https://www.mhtechnicalservicesllc.com/villa-movers-and-packers-in-dubai/"> Villa Movers and Packers Dubai </a> Our team can help you with packing, unpacking, loading, and unloading of your belongings. We are Best Movers and Packers in Dubai, Moving Companies, Villa Movers in Dubai, Local Movers in Dubai. Best Dubai movers and packers for office, house, villa shifting and storage in Dubai. As a leading packers and movers in Dubai, we are a 'one-stop-shop' for all your office relocation needs.

Reply

5/11/2021 04:54:55 am

We are the professional <a href="https://www.pickuprentaldubai.ae/">furniture packers</a> furniture packers and movers in Dubai. Providing Cheapest Movers Service, Reliable and Hassle-free Service. We are expert and professional in packing and moving your office furniture in Dubai. Our office move action plans are carefully drawn up to minimize the loss or damages of your office furniture.

Reply

Ankurkumar Patel

6/14/2021 01:47:45 pm

For me Mr. Pabrai is guru ideal person and the book written by you is read by 5 times , thank you once again for your effort to make common people understand the essence of business.

Reply

Wemoversseo

6/29/2021 01:03:33 am

"

Reply

10/23/2021 01:26:22 am

Thanks for sharing these tips. I found these tips very helpful. I believe that every mother like me who is reading this article now is truly happy about this very informative article.Great content! Thank you for sharing!

Reply

6/15/2022 09:20:57 am

Government of Telangana state is providing financial assistance to the Scheduled Caste, Scheduled Tribe, Backward Class, Disabled, and Economically Backward Class students studying post-matriculation courses on saturation approach to enable them to complete their education.

Reply

6/22/2022 09:37:00 am

For me Mr. Pabrai is guru ideal person and the book written by you is read by 5 times , thank you once again for your effort to make common people understand the essence of business.

Reply

8/23/2022 12:18:13 pm

Fabulous..such good service.” Thank you… I have never had such good service.

Reply

9/13/2022 02:53:39 pm

Irresistible! Thank you so much for this kind and good service.your services is better than better.

Reply

10/27/2022 09:49:34 am

Such a fantastic information. This is honestly very useful for bloggers

Reply

Leave a Reply. |

Mohnish PabraiMohnish Pabrai is the founder and Managing Partner of the Archives

April 2024

Categories |

RSS Feed

RSS Feed