|

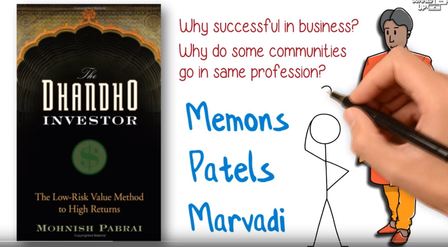

I enjoyed this video that summarized the Patels’ business practices from "The Dhandho Investor." The video explores how the Patels got into the motel business in the U.S, their low cost operating model and high return on equity. Heads I win, tails I don't lose much!

https://www.youtube.com/watch?v=INSuLnQJvuY&feature=youtu.be&a Enjoy!

7 Comments

In late December 2016, I co-wrote an article on Forbes.com that introduced the "Uber Cannibals," a five-stock investing strategy that invests in businesses aggressively buying back their own stock. This is a "set it and forget it for one year" strategy that rebalances every April when 5 companies are selected for the portfolio for the upcoming year.

The Uber Cannibals draft season is now upon us, and it's time to pick our 2018 - 2019 team. As a recap, in my 3/31/17 blog post, we met Ms. Sonia Patel, who had embarked on her Uber Cannibals investing journey with $100,000 from her IRA account at Interactive Brokers. Sonia invested in the first 5 Uber Cannibals on 1/3/17, and then rebalanced her portfolio in April 2017 with the 2017 - 2018 Uber Cannibals, which were:

As of 3/29/18, Sonia's $100k was worth $130,646 (after trading costs), up 30.6%. If Sonia had instead invested in the S&P 500 over that period, she would be up 20.9% and her portfolio would be worth approx. $10k less, or $120,907.

Lowe's and Hackett Group paid dividends totaling $744. Per our rules, Sonia reinvested those dividends back into the same businesses.

The Ubers are doing quite well! This strategy makes sense if you intend to follow it for at least a decade or two (or longer). So we shouldn't fixate too much on short term performance. But I am happy to see that Sonia is off to a great start. Keep at it Sonia! The New Uber Cannibals: For 2018 - 2019, our algorithms selected the following five Uber Cannibals:

Sleep Number Corp. (which recently changed its name from Select Comfort) will continue to be in the portfolio for another year. But we have four new kids on the block. If you invested in the Uber Cannibals in April 2017, then leave Sleep Number Corp untouched, and sell Lowe's, NVR, Hackett, and Willis Lease. Then invest the proceeds equally among the four new kids: Corning, PulteGroup, Discover Financial Services, and Lear. Below is the 1 year return of the 2017-2018 Uber Cannibals through 3/29/18:

If you invested in the Uber Cannibals in April 2017 in a taxable account, try to sell the winners (currently Lowe's, NVR and Willis Lease) after holding them for at least 366 days and the losers (Hackett) after no more than 364 days.

If you are a new investor to the Uber Cannibals, you can just equal weight the five stocks (i.e., invest the same amount of money in each of these five) and keep that portfolio until April 2019, when I'll provide the 2019 - 2020 portfolio on www.ChaiWithPabrai.com. Happy Cannibal Investing! Note, anyone who invests in any strategy needs to do their own research/due diligence and are themselves fully responsible for the outcome. “Compounding is the 8th Wonder of the World” – Lecture & Q&A at Peking University – Dec. 22, 20173/27/2018 I very much enjoyed visiting the campus of Peking University's Guanghua School of Management with Guy Spier and Monsoon Pabrai to give my second lecture entitled “Compounding is the 8th Wonder of the World.”

The presentation was followed by a rich Q&A session on a diverse range of topics. The lecture covered my favorite subjects – compounding, Rule of 72 and Warren Buffett. Enjoy! https://www.youtube.com/watch?v=z74NaYRyMJo&t=6564s Here is the link to the podcast: If you prefer reading over listening, here is the transcript. |

Mohnish PabraiMohnish Pabrai is the founder and Managing Partner of the Archives

July 2024

Categories |

RSS Feed

RSS Feed