|

I enjoyed my session with Rotary Club Bangalore DownTown and Fellowship of Wealth Creators. I talked about profit and non-profit organizations, the Dakshana Foundation model and success stories, and various approaches to philanthropy.

Enjoy! www.youtube.com/watch?v=uzp37XkxWxY Here is the link to the podcast: If you prefer reading over listening, here is the transcript.

1 Comment

I have been made aware that scammers and fraudsters are using my name, picture and doctored videos to target people online with fraudulent attempts to send money to be invested in non-existent investment schemes or for compensation for investment tips. The examples I’ve seen so far have been in perpetrated in India, but they may be elsewhere too. These are totally fake. Please read below to protect yourself:

I very much enjoyed my session at the University of Nebraska, Omaha. I talked about a business's intrinsic value and how an owner defines it, focusing on downside in investments, and cloning successful models.

Enjoy! www.youtube.com/watch?v=FFxUSADENrc Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I enjoyed my session with the Dakshana scholars at JNV Pune. I talked about the success stories of Dakshana scholars, varied education systems and advantages of developing the public speaking skills.

Enjoy! www.youtube.com/watch?v=bUUl4trjNC8 Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I very much enjoyed my interview with Shaan Puri at My First Million podcast. I talked about Warren Buffett's early entrepreneurial adventures, learnings from Buffett and Charlie Munger, and some basic traits of value investors and entrepreneurs.

Enjoy! www.youtube.com/watch?v=TyYRrfY3_zM Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I enjoyed my session with Dakshana scholars at JNV Bangalore Urban. I talked about cloning Super 30 to form the Dakshana Foundation, Akshaya Patra foundation and returns of investment in philanthropy.

Enjoy! www.youtube.com/watch?v=ktBWoEHl9UU Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I very much enjoyed my interview with Stig Brodersen at The Investor's Podcast. I talked about the happiness equation, the importance of trust and reliability, and the game of investing.

Enjoy! www.youtube.com/watch?v=kTXZO5N_FK4 Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I very much enjoyed my interview with Massachusetts Institute of Technology's Brass Rat Investments. I talked about Berkshire's investment in See's Candies vs Coke, learnings from Charlie and about finding anomalies.

Enjoy! www.youtube.com/watch?v=yHIz0WlMnMc Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I enjoyed my session with Dakshana scholars at JNV Kottayam. I talked about the Dakshana scholar Ashok Kumar's success story, cloning Super 30 and the importance of being a harsh grader.

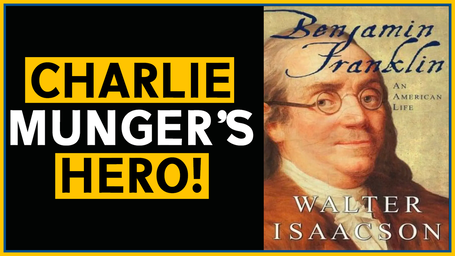

Enjoy! www.youtube.com/watch?v=R_pnRg24btM Here is the link to the podcast: If you prefer reading over listening, here is the transcript. I enjoyed my session with YPO Mosaic United. I talked about Charlie Munger's mental models, his outlook towards relationships and the powerful tool of cloning.

Enjoy! www.youtube.com/watch?v=pu8M0SsqRtg Here is the link to the podcast: If you prefer reading over listening, here is the transcript. |

Mohnish PabraiMohnish Pabrai is the founder and Managing Partner of the Archives

July 2024

Categories |

RSS Feed

RSS Feed